Excitement About Lamina Loans

Wiki Article

What Does Lamina Loans Do?

Table of ContentsGetting The Lamina Loans To WorkFacts About Lamina Loans RevealedThe Buzz on Lamina LoansLamina Loans for DummiesMore About Lamina LoansNot known Incorrect Statements About Lamina Loans Getting My Lamina Loans To Work

Lots of states cap the amount you can borrow with cash advance car loans at $500. Payday loan expenses such as interest rates and fees can differ significantly.There may be other risks and also expenses to consider based on your personal situation and also the products as well as solutions being used. If you're incapable to settle your finance, the loan provider might charge you late costs or other penalties. The loan provider can send your debt to a debt collection agency or they may garnish your incomes.

A rollover, likewise referred to as a funding extension or renewal, enables customers to extend their funding though this isn't allowed all states. Rollovers may supply short-term relief, however they can swiftly gather even more financial obligation as well as make it even harder to repay the lending. Though a lot of payday loan providers do not report to the credit score bureaus, if you fail to settle the funding the financial debt may be sent out to collections.

Lamina Loans Can Be Fun For Anyone

These financings might additionally come with high rates of interest, but longer settlement terms expanded the price right into smaller, extra convenient bi-weekly or month-to-month payments. This kind of borrowing can still be high cost, so ensure to carefully read the terms as well as examine your options before choosing if this is right for you.This might be a savings account or deposit slip. The quantity you deposit will usually be your credit restriction (Lamina Loans). These types of bank card can help you develop your credit history with on-time payments as well as they'll typically have a reduced interest rate than some of the other options. In some scenarios, it might be much better to obtain a small lending from a buddy or relative.

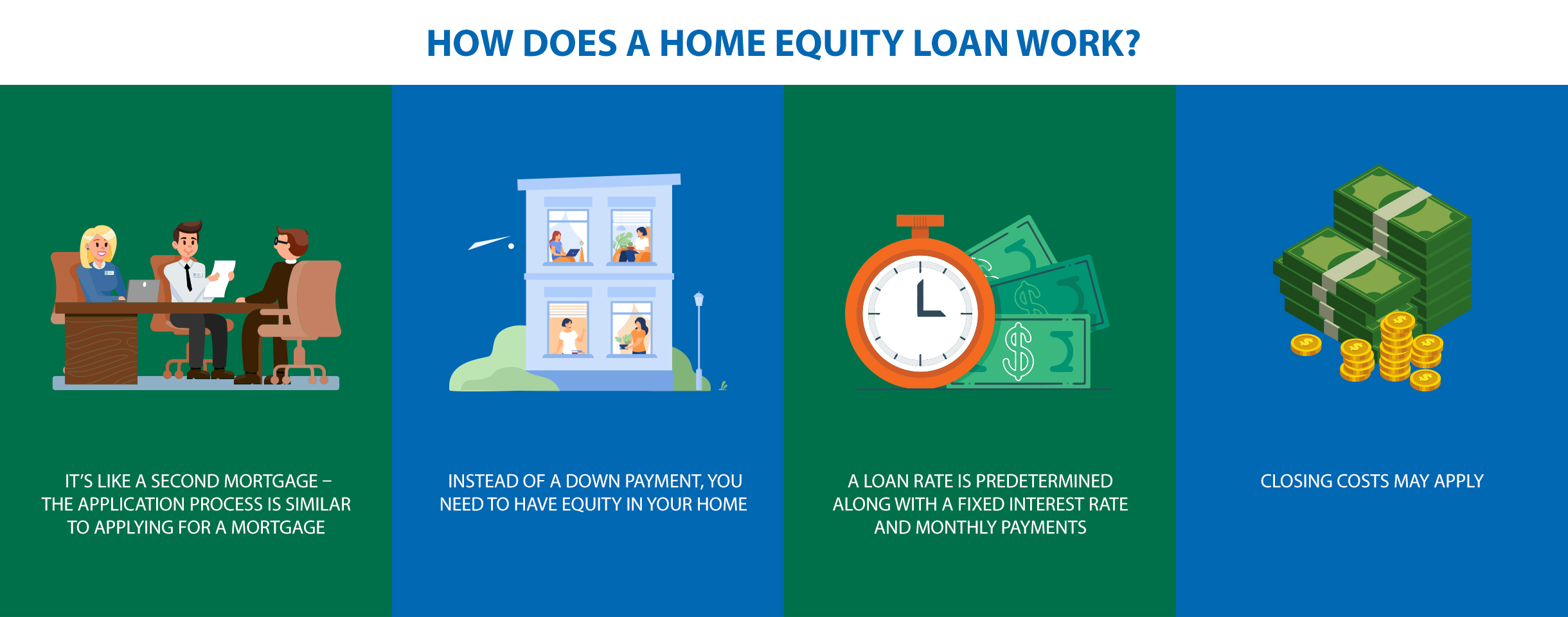

A title lending is a loan in which a vehicle serves as security for the car loan quantity. The accessibility of financings and the funding quantity supplied varies for each state where we supply title car loans.

Getting The Lamina Loans To Work

You can apply for a title loan in-store in Arizona, Louisiana, Oregon, select Tennessee shops, and Texas stores (not supplied in Austin, Ft Well Worth, or Dallas). In Arizona, you may likewise be able to apply for a registration car loan.If authorized, you get the money, and also you get to keep driving your automobile. Yes, title finances are offered for bikes in-store, and the demands are the same as for title fundings.

Lamina Loans Can Be Fun For Everyone

It'll add up to even more than any late charge or bounced check fee you're attempting to avoid. Contrast payday advance rates of interest of 391%-600% with the average rate for more information alternative options like charge card (15%-30%); debt administration programs (8%-10%); personal finances (14%-35%) and online financing (10%-35%). Should payday finances also be thought about an alternative? Some states have punished high rate of interest somewhat.For $500 lendings, 45 states and Washington D.C. have caps, but some are pretty high. The average is 38. 5%. However some states do not have caps in any way. In Texas, rate of interest can great post to read go as high as 662% on $300 obtained. What does that mean in genuine numbers? It indicates that if it you pay it back in 2 weeks, it will certainly cost $370.

Incidentally, five months is the average amount of time it requires to pay back a $300 payday advance loan, according to the Seat Philanthropic Trust Funds. So prior to you get at that quick, very expensive money, recognize what payday advance loan require. The Customer Financial Security Bureau presented a collection of guideline adjustments in 2017 to aid safeguard debtors, including forcing cash advance lending institutions what the bureau calls "tiny dollar loan providers" to identify if the borrower might afford to tackle a funding with a 391% rates of interest, called the Required Underwriting Guideline.

The Basic Principles Of Lamina Loans

A lending institution can't take the debtor's automobile title as security for a funding, unlike title car loans. A lender can't make a financing to a consumer that already has a short-term finance. The lending institution is restricted to extending car loans to borrowers who have actually paid a minimum of one-third of the primary owed on each expansion.

If a consumer can not repay the loan by the two-week due date, they can ask the loan provider to "roll over" the car loan. If the customer's state permits it, the customer just pays whatever fees schedule, and the finance is prolonged. The rate of interest grows, as do finance costs. As an example, the average cash advance is $375.

Rumored Buzz on Lamina Loans

25 for a total car loan quantity of $431. If they chose to "roll over" the cash advance financing, the brand-new quantity would certainly be $495. That is how a $375 loan ends up being virtually $500 in one month.The typical passion or "finance fee" as cash advance lenders refer to it for a $375 financing would certainly be between $56. 25 and $75, depending upon the terms. That interest/finance cost generally is someplace in between 15% and also 20%, relying on the lender, but can be greater. State laws control the optimum rate of interest a payday lending institution might bill.

If you utilized a bank card instead, also at the greatest bank card rate readily available, you are paying much less than one-tenth the quantity of passion that you would on a cash advance. Surveys recommend that 12 million American consumers obtain cash advances every year, despite the ample evidence that they send out most customers into deeper financial debt.

The Lamina Loans Statements

Neighborhood agencies, churches and also private charities are the simplest places to try. Many companies use employees an opportunity to get cash they gained before their paycheck schedules. For instance, if an employee has actually worked seven days and also the following scheduled paycheck isn't due for one more five days, the company can pay the worker for the 7 days.Report this wiki page